Introduction

Applying for and maintaining an Australian Financial Services Licence (AFSL) entails significant costs, both upfront and ongoing. Accurate cost assessment is crucial for financial service companies and start-ups considering self-licensing. This assessment helps businesses make informed decisions, budget effectively, and avoid unexpected financial burdens.

This article provides a comprehensive overview of indicative AFSL costs, covering application, set-up, and ongoing compliance. We will also delve into real-world cost examples from a law firm specialising in financial services licensing, offering practical insights for businesses navigating the AFSL landscape.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Set-Up Costs for Your AFSL Licence Application

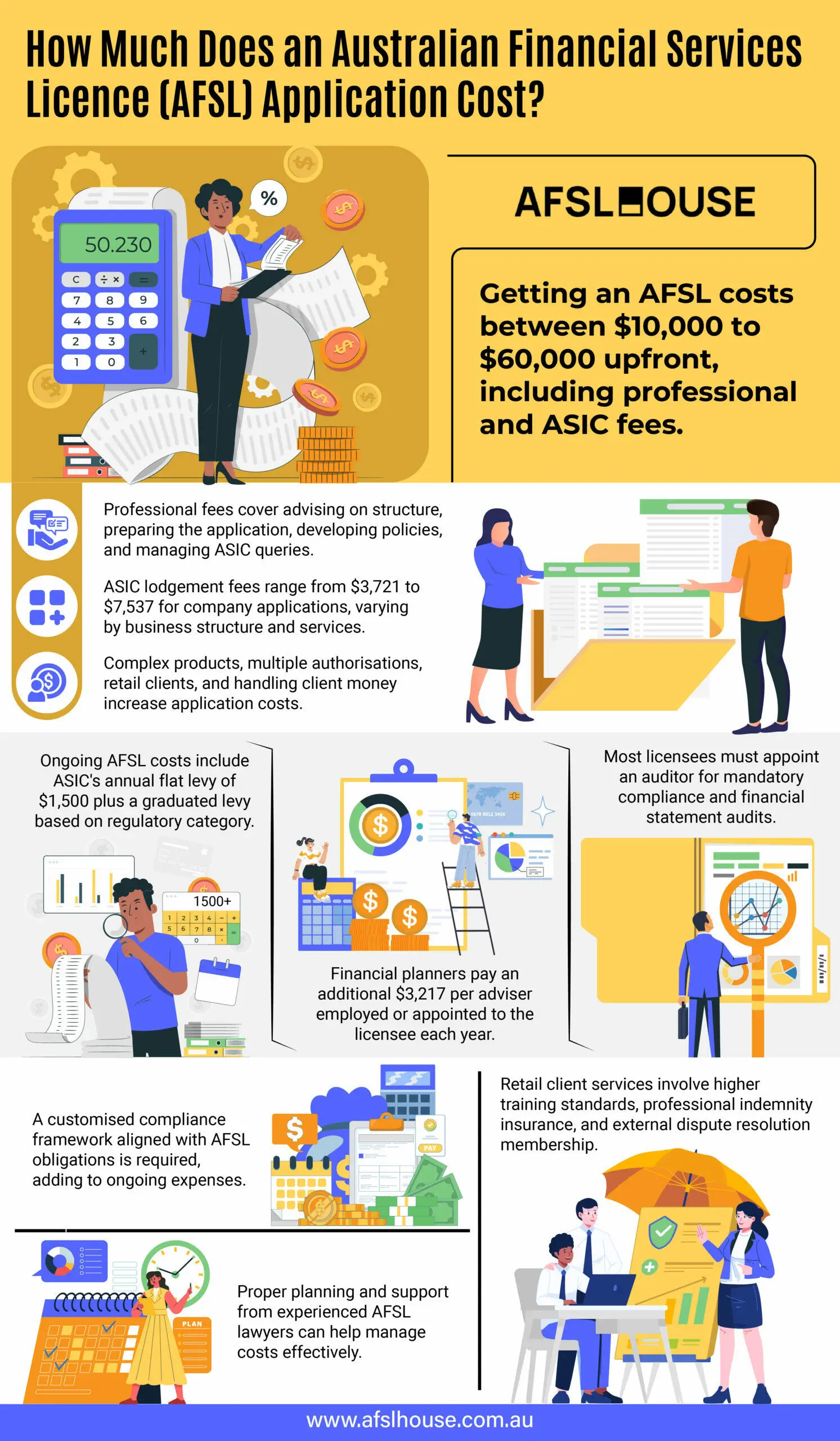

The initial costs to apply for an AFSL typically range between $10,000 to $60,000, depending on the complexity of your application. The total cost includes both professional fees and ASIC lodgement fees. The total cost includes both professional fees and ASIC lodgement fees.

Professional Fees for Preparing and Submitting an AFSL Application

Professional fees for AFSL application preparation and submission vary based on the authorisations being sought and the complexity of your business arrangements, so consulting experienced AFSL lawyers can help clarify your expected costs. A standard AFSL application package typically includes:

- Advising on shareholding structure for the AFSL company

- Guidance on selecting appropriate responsible managers

- Preparation of all required supporting documents, including the new streamlined ‘People Proofs’ for all responsible persons

- Development of customised policies and procedures

- Creation of privacy compliance and AML compliance programs

- Managing ASIC queries and requisitions

- Guidance and completion of the online AFSL application ‘transaction’ within the ASIC Regulatory Portal, as well as support for ACL applications if your business requires both licences.

ASIC Lodgement Fees for AFSL Applications

ASIC’s application fees vary significantly based on your business structure and the type of financial services you plan to provide:

- For financial planners: $3,721 for a company application submitted via the ASIC Regulatory Portal

- For responsible entities or market makers: $7,537 for a company application submitted via the ASIC Regulatory Portal

- Individual applications may have different fee structures compared to corporate applications

The fees are typically lower for simpler license applications and increase with the complexity of the authorisations being requested. Alternatively, businesses may consider the AFSL marketplace for acquiring an existing licence. Factors that can drive up costs include:

- Complex financial products (e.g., derivatives or foreign exchange)

- Multiple authorisations requiring multiple Responsible Managers

- Membership in a large corporate group

- Providing services to retail clients

- Handling client money or assets

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Ongoing AFSL Compliance Costs and Obligations for Licensees

ASIC Industry Funding Levy for AFS Licensees

ASIC requires licensees to pay both an annual flat levy and, in some cases, a graduated levy based on their regulatory category. For financial planners, this means an annual flat levy of $1,500 plus an additional levy of $3,217 per adviser employed by or appointed to the licensee.

Audit and Compliance Framework Costs for Maintaining an AFSL

Most licensees must appoint an auditor to conduct mandatory compliance and financial statement audits, with limited licensees like accountants being exempt from this requirement. Additional costs include establishing and maintaining a robust compliance framework.

The compliance framework must be customised to meet all AFSL obligations, including policies and procedures that align with AFSL compliance regulation requirements.

Additional Costs for Retail Client Services under an AFSL

Licensees providing services to retail clients face several additional mandatory expenses:

- Higher training standards and increased supervision requirements for representatives, as these are key to demonstrating organisational competence

- Professional indemnity insurance coverage to protect against potential claims and meet regulatory requirements

- Membership fees for an external dispute resolution scheme to handle customer complaints and meet regulatory obligations

These ongoing compliance costs vary depending on the type of license held and services provided. The total expense structure is designed to ensure licensees maintain appropriate standards while protecting consumer interests.

Conclusion

Understanding the true costs of obtaining and maintaining an AFSL is crucial for financial services businesses considering self-licensing. Despite common misconceptions about astronomical expenses, the reality is more manageable when approached with proper planning and the right support structure.

To explore cost-effective strategies for your AFSL application and ongoing AFSL compliance, consider reaching out to our team at AFSL House. We provide tailored advice and practical insights to help you optimise your licensing budget and ensure long-term financial sustainability.

Frequently Asked Questions

ASIC application fees vary based on the type of financial services being provided. For financial planners, an online company application costs $3,721, while responsible entities or market makers face a higher fee of $7,537.

Several factors influence the total cost, including the complexity of your business and financial products. Multiple authorisations requiring multiple Responsible Managers, being part of a large corporate group, and providing services to retail clients also increase costs. Handling client money or assets adds further complexity and cost.

Ongoing costs include ASIC levies (a flat fee and a per-adviser fee), mandatory compliance audits, and maintaining a robust compliance framework. Additional capital requirements may apply depending on the financial services provided.

Legal professionals specialising in AFSLs can help ensure a complete and compliant AFSL application, minimising potential delays or refusals. They provide expertise on structuring the application, selecting responsible managers, and developing necessary compliance programs. This assistance streamlines the process and increases the likelihood of a successful outcome.

Yes, servicing retail clients incurs additional costs when compared to wholesale clients. These include higher training and supervision standards for representatives, professional indemnity insurance, and membership in an external dispute resolution scheme – all of which are not required for AFSL holders serving wholesale clients. These requirements ensure greater consumer protection and add to the overall compliance burden.

Consulting with legal professionals specialising in financial services licensing is recommended for a tailored cost estimate. They can assess your specific business needs and provide a more accurate projection of both initial and ongoing expenses.

Some believe obtaining an AFSL costs $1 million or that initial compliance quotes are just the beginning, with hidden costs later. Another misconception is that compliance costs will overwhelm a standalone business. These misconceptions often deter businesses from seeking their own AFSL.

Strategies for managing costs include leveraging technology and potentially outsourcing some compliance services. Efficient processes and utilising shared resources can also contribute to cost-effectiveness.

Disclaimer: All information provided in this article is strictly general in nature and is not intended to be, nor should it be relied upon as, legal advice.